Navigating the South Carolina Earned Wage Access (EWA) Services Act

South Carolina's General Assembly has enacted the "South Carolina Earned Wage Access Services Act," which aims to regulate businesses providing early access to earned wages.

This Act significantly impacts companies operating in, or planning to operate in, this sector within the state. Understanding its requirements is crucial for securing the necessary licenses.

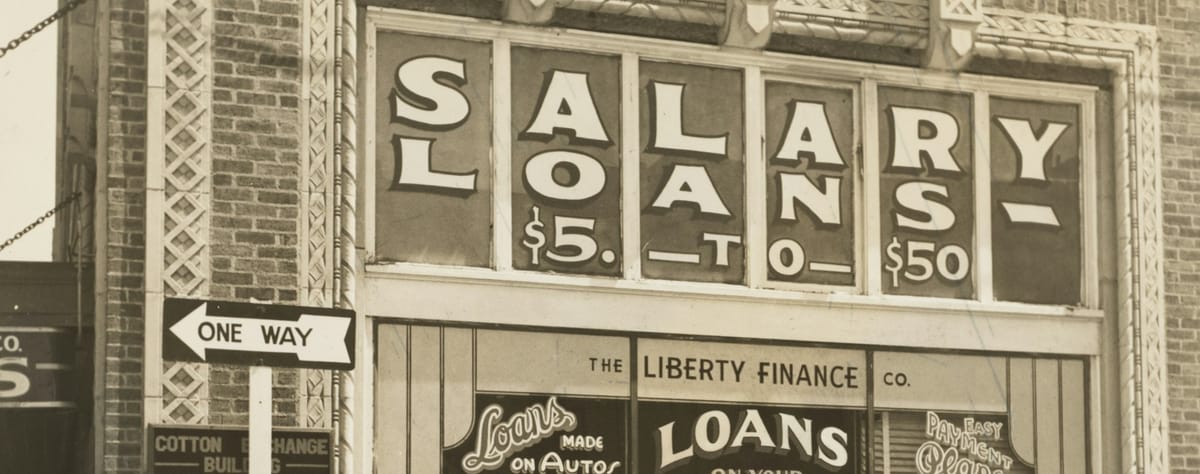

What is Earned Wage Access?

Earned wage access (EWA) services allow employees to access their earned but unpaid wages before their official payday. The Act defines several terms:

- Consumer: A natural person residing in South Carolina.

- Consumer-directed wage access services: EWA services offered directly to consumers based on their representations of earned income.

- Employer: The entity obligated to pay the consumer's wages (including independent contractors).

- Provider: The business offering EWA services.

- Proceeds: The payment a provider makes to the consumer.

- Employer-integrated wage access services: EWA services delivered using data obtained from employers.

Licensing and Registration:

The Act mandates registration for any person offering EWA services in South Carolina, regardless of physical location within the state. This applies unless the provider operates under existing regulations for banks, credit unions, etc. The application for registration requires:

- Business name(s).

- Principal office address (can be outside South Carolina).

- Addresses of all in-state offices/stores.

- Description of service delivery methods (if not in an office or store).

- Employer Identification Number (EIN).

- Privacy policy.

- Fee schedule, clearly stating a no-cost option for users.

- Surety Bond: A $30,000 surety bond is required to ensure faithful performance of obligations and must be maintained for three years after revocation, denial, or failure to renew. This acts as a form of financial protection for consumers.

Key Compliance Requirements for Providers:

- Transparency: Providers must disclose all fees and provide a no-cost option to consumers. This must be prominently displayed in contracts and communications.

- Consumer Protection: Providers must have clear policies and procedures for handling consumer inquiries and complaints.

- Privacy: Compliance with all applicable state and federal privacy and data security regulations.

- No Penalties for Early Termination: Consumers must be able to stop using the service anytime without financial penalty.

- Prohibited Actions: The bill prohibits charging late fees, interest, or other penalties for unpaid proceeds and sharing consumer fees with the employer.

Before You Begin:

Review the full text of the Act here before starting the registration process. It's also wise to consult with legal counsel specializing in compliance with financial services to ensure complete understanding and full adherence.

Comments ()